As the owner of San Jose Roof Repair, located right here in San Jose, California, I understand how overwhelming filing an insurance claim for roof damage can be.

Here's a step-by-step guide to help you through the process:

First, make sure to document your roof damage thoroughly with photos and videos before reaching out to your insurance company.

It's crucial to review your policy details, focusing on coverage and deductibles, before filing your claim, whether online or by phone.

When the insurance adjuster comes for an inspection, having a trusted roofing expert, like someone from our team at San Jose Roof Repair, can ensure that all damage is accurately noted.

Afterward, carefully review the claim documents.

It's essential to select a licensed contractor experienced in handling insurance work to conduct the repairs.

Our team at San Jose Roof Repair has extensive experience working with insurance claims and can assist you in monitoring the repairs to ensure everything is completed to the highest standards.

Navigating the insurance process can be tricky, but by following these key steps and relying on our expertise, you'll be well-equipped to manage it successfully.

Evaluating Your Roof's Condition

A thorough roof evaluation forms the foundation of any successful insurance claim. Start by walking around your home to spot obvious issues like missing shingles, cracks, or sagging areas. You'll want to document everything you find with clear photos and videos.

Don't forget to check your attic – it's often where you'll first spot signs of water damage or structural problems. Look for dark spots, mold, or daylight peeking through. Pay attention to areas where water might pool or where you've got temporary patches.

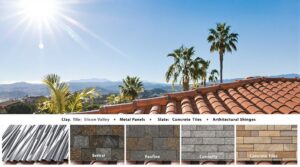

As you inspect, make note of your roof's age, material type, and any recent repairs. Record specific measurements of damaged sections and watch for things like curled shingles or streaking. Remember to date all your photos and mark their locations – you'll need this for your claim.

Starting Your Insurance Claim

Once you've thoroughly documented your roof's condition, it's time to get your insurance claim going. Start by reviewing your policy to understand what's covered and what your deductible is. You'll want to get a reliable local roofer to provide a detailed estimate of the damage.

Contact your insurance company to file your claim online or by phone. You'll need to share specific details about when the damage occurred and how much repairs might cost. Make certain you've got your photos and videos ready to submit as evidence. Your insurance company will likely schedule an adjuster to inspect your roof.

It's smart to have your contractor present during the adjuster's visit to guarantee nothing gets overlooked. Keep copies of all documentation and stay ready to follow up on your claim's progress.

Working With Insurance Adjusters

Working with insurance adjusters might feel intimidating, but knowing what to expect can make the process smoother. You'll need to cooperate fully by providing access to your roof and any documentation they request during the inspection.

When the adjuster arrives, have your trusted roofer present to help point out damage and explain technical details. Don't hesitate to ask questions about anything you don't understand during the inspection. Take notes and guarantee you're clear about their findings.

Once you receive the adjuster's report, review it carefully with your roofer. If you disagree with their assessment, you can negotiate for a better settlement by providing additional evidence or documentation. Remember, it's your right to challenge their findings if you believe they've missed important damage or undervalued the repairs needed.

Reviewing Claim Documents

Before you sign any insurance claim documents, take time to carefully review every detail of the paperwork. Make sure the damage descriptions match your documentation and photos, and verify that all affected areas are included in the report. Double-check the coverage amounts and deductibles against your policy.

Keep copies of everything, including your communications with the insurance company and adjuster. If you spot any discrepancies or have questions about the claim decision, don't hesitate to ask your insurance agent for clarification. It's important to understand exactly what repairs will be covered and what you'll need to pay out of pocket. If you're not comfortable with the paperwork, consider having a professional contractor or public adjuster review the documents before signing.

Choosing Your Contractor

Selecting the right contractor is one of the most critical decisions you'll make during your roof repair process. You'll want to find someone who's experienced with insurance claims and has a solid track record in San Jose.

Start by getting multiple quotes and checking each contractor's credentials. Make sure they're licensed, bonded, and insured. Don't be tempted by unusually low bids – they often signal poor workmanship. Look for contractors who belong to professional roofing associations and have specific experience with storm damage repairs.

Your chosen contractor should inspect your roof before the insurance adjuster arrives and help document all damage. They should provide a detailed written contract and explain their warranty terms clearly. Remember to verify their local reputation through reviews and check their references before making your final decision.

Complete The Repair Process

Moving forward with repairs requires careful attention to several key steps. Before work begins, review your settlement offer carefully to make sure it covers all the necessary repairs for your San Jose home.

Once you're ready, stay in close contact with both your insurance company and your chosen contractor. You'll want to document everything throughout the repair process – take plenty of before and after photos of your roof. Keep all paperwork, including receipts and warranties, in a safe place.

As repairs wrap up, double-check that all work matches what was outlined in your claim. Make sure you're satisfied with the quality before making final payments. If any issues come up during or after repairs, don't hesitate to contact your insurance company or contractor for resolution.

Frequently Asked Questions

How Long Do I Have to File a Roof Damage Claim?

You've typically got up to one year to file a roof damage claim for storm-related issues, but don't wait that long. For water damage, you'll need to act fast – within 48 hours of finding it. If it's hail damage, you might have up to two years in some places. Check your policy, though, as timeframes vary by insurance company. It's always best to file right away for the best chance of approval.

Will Filing a Roof Claim Increase My Insurance Premiums?

Yes, filing a roof claim will likely increase your insurance premiums. Insurance companies consider your claim history when setting rates, and any claim can trigger a rate hike. The size of the increase depends on factors like the cost of your claim, your previous claim history, and your insurer's policies. Some companies offer "first claim forgiveness," but it's best to check with your insurance provider about their specific premium adjustment policies.

Can I Get Multiple Roof Repairs Covered Under One Claim?

Yes, you can get multiple roof repairs covered under a single claim if they're all related to the same incident or event. For example, if a storm damages several areas of your roof, you won't need separate claims for each damaged section. Just make sure you document all the damage thoroughly when you file. However, if damages happen from different events at different times, you'll need separate claims.

What Happens if My Insurance Claim Is Denied?

If your claim is denied, don't let it feel like the end of the world. You've got options. First, review your denial letter carefully to understand exactly why they rejected your claim. Then, gather tons of evidence – photos, contractor reports, and maintenance records to support your case. You can file an appeal with your insurance company, and if needed, consider hiring a public adjuster or attorney to help fight your case.

Should I File a Claim for Minor Roof Damage?

For minor roof damage, you shouldn't rush to file an insurance claim. First, check your deductible – if repair costs are less than or close to it, it's better to pay out of pocket. Filing small claims can raise your premiums and might not be worth it in the long run. Instead, get an estimate from a reliable contractor and compare it to your deductible before making your decision.

Conclusion

As the owner of San Jose Roof Repair, I understand that filing a roof claim in San Jose can feel daunting, but it doesn't have to be. With over 40% of home insurance claims in California being roof-related, rest assured you're not alone in this journey. Remember to document everything, work closely with your adjuster, and choose a licensed contractor. At San Jose Roof Repair, we're here to help you every step of the way. By staying organized and following our expert guidance, you'll soon have your roof repaired and your home protected. Don't hesitate to reach out to us for professional roofing services. Call us today at 650-414-5505!